MCK Private Equity Fund

Systematic investing in global Private Equity

Features

The MCK Private Equity Fund is an innovative investment fund managed by Machine Capital. It offers unique features that make it an excellent addition to almost any portfolio.

Accesible

Most private equity investments have a very high minimum investment amount. By investing in the universe of listed private equity, the fund makes the benefits of this asset class accessible to smaller investors.

Systematic portfolio construction

The algorithm generates the portfolio by decomposing various private equity indices into a portfolio of exchange traded securities which are automatically bought, sold and rebalanced within the programme.

Low costs

Through the listed universe in combination with a systematic quant program, investors achieve a low-cost solution for investing in the private equity market.

Liquid Alternative

Whilst having the same risk and return characteristics, the fund does not have the long-term lockups or other liquidity issues of direct private equity investments.

Performance

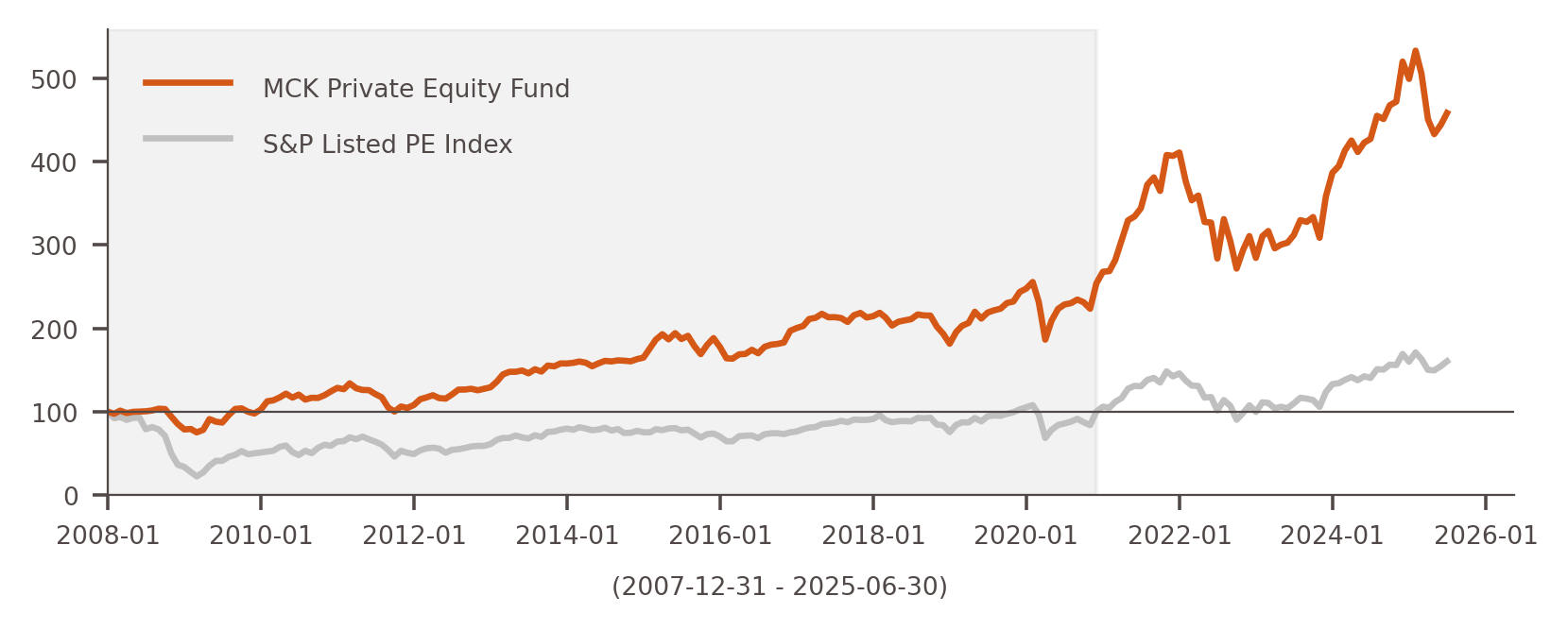

Realised performance compared to the S&P Listed Private Equity index

| MCK Private Equity Fund | S&P Listed PE Index | ||

|---|---|---|---|

| Last 5 Years | Total Return | 100.7% | 87.1% |

| Annual Return | 14.9% | 13.4% | |

| Annual Risk | 22.7% | 23.6% | |

| Last 10 Years | Total Return | 145.0% | 107.1% |

| Annual Return | 9.4% | 7.6% | |

| Annual Risk | 19.9% | 22.4% | |

| Last 15 Years | Total Return | 281.1% | 235.8% |

| Annual Return | 9.3% | 8.4% | |

| Annual Risk | 17.6% | 21.3% | |

| Since Inception | Total Return | 358.6% | 60.4% |

| Annual Return | 9.1% | 2.7% | |

| Annual Risk | 17.8% | 26.2% |

| MCK Private Equity Fund | S&P Listed PE Index | ||

|---|---|---|---|

| NAV | Return | Return | |

| 2025 (ytd) | 171.16 | -8.2% | 0.3% |

| 2024 | 186.44 | 29.2% | 20.2% |

| 2023 | 144.34 | 35.9% | 33.6% |

| 2022 | 106.21 | -30.8% | -31.7% |

| 2021 | 153.45 | 53.4% | 37.8% |

| 2020 | 100.00 | 8.2% | 0.6% |

| 2019 | 36.5% | 39.4% | |

| 2018 | -15.4% | -17.2% | |

| 2017 | 7.1% | 19.8% | |

| 2016 | 12.9% | 8.9% | |

| 2015 | 7.7% | -7.1% | |

| 2014 | 4.5% | -5.5% | |

| 2013 | 22.1% | 30.5% | |

| 2012 | 19.8% | 24.4% | |

| 2011 | -16.0% | -23.3% | |

| 2010 | 25.3% | 25.9% | |

| 2009 | 30.5% | 51.8% | |

| 2008 | -21.5% | -66.5% | |

Results before 2021-1-1 (the shaded area in the graph) are the realised performance of the same strategy as part of a larger portfolio managed by another investment manager.

Past performance is not indicative of future results.

How to invest?

To invest in the fund is easy:

1. Fill in the subscription form

2. Transfer the amount to the ING bank account of the fund

3. You buy against the monthly NAV

You can download the prospectus for the fund and other documents in the Clients area. Please contact us for your login details.

The MCK Private Equity Fund is a Dutch fund structure ("Fonds voor Gemene Rekening") and is administered by a professional third party. The accountant performs twice a year an audit and issues a (half)year report of the fund.

The fund is registered with the Dutch financial regulator, the AFM. Because of the investment threshold of €100k the fund is deemed to have only sophisticated investors and will therefore not be regulated by the AFM on a day-to-day basis.

Please contact us if you would like to know about the fund. We can explain the investment process in more detail.