MCK KEq Fund

Systematic investing in global equities

Features

The MCK KEq Fund is an innovative investment fund managed by Machine Capital. It offers an efficient way of investing in a large and diverse range of companies all over the world and could be the core of any investment portfolio.

Diversification

Instead of betting on a limited number companies, the fund invests in a portfolio of over 3,000 companies across the globe and active in many different industries. This creates a diversified and balanced portfolio.

Systematic portfolio construction

The algorithm generates the portfolio by following the allocations of a global equity portfolio of which the risk components in index trackers are automatically bought, sold and rebalanced.

Beyond Market Cap

In most equity portfolios, the weights of different regions in the portfolio are only determined by the total value of their equity markets. This leads to some regions (the US) being overrepresented relative to their share of the global economy. The KEq Fund aims to avoid this distortion.

Efficient

Through the listed universe in combination with a systematic program, investors achieve a efficient solution for investing in a well-balanced portfolio of global equity investments.

Performance

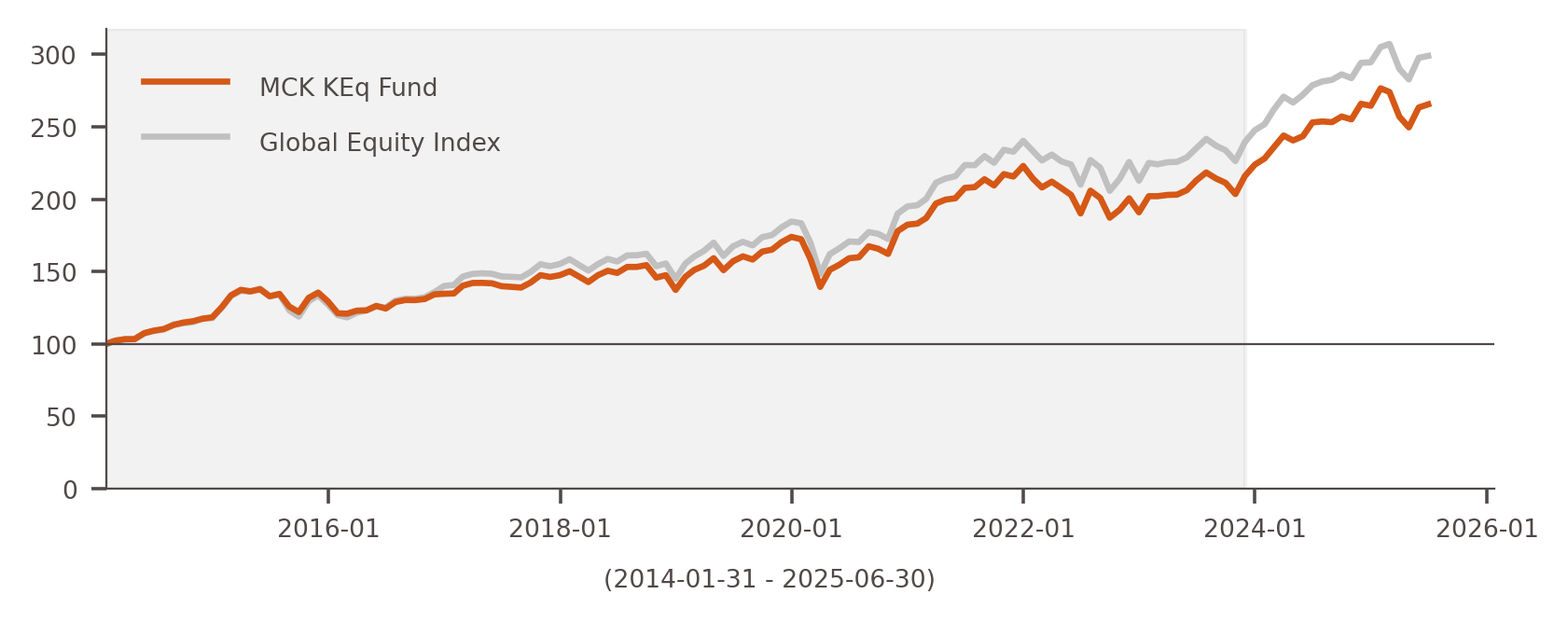

Performance compared to the Global Equity Index

| MCK KEq Fund | Global Equity Index | ||

|---|---|---|---|

| Last 5 Years | Total Return | 66.8% | 75.1% |

| Annual Return | 10.8% | 11.9% | |

| Annual Risk | 11.9% | 11.8% | |

| Last 10 Years | Total Return | 99.7% | 125.4% |

| Annual Return | 7.2% | 8.5% | |

| Annual Risk | 12.4% | 12.6% | |

| Since Inception | Total Return | 165.6% | 199.1% |

| Annual Return | 8.9% | 10.1% | |

| Annual Risk | 12.0% | 12.2% |

| MCK KEq Fund | Global Equity Index | |

|---|---|---|

| 2025 (ytd) | 0.4% | 1.5% |

| 2024 | 18.2% | 19.0% |

| 2023 | 17.2% | 16.4% |

| 2022 | -14.4% | -11.5% |

| 2021 | 22.3% | 23.2% |

| 2020 | 4.9% | 5.7% |

| 2019 | 26.7% | 27.2% |

| 2018 | -6.9% | -6.6% |

| 2017 | 9.5% | 10.9% |

| 2016 | 4.1% | 10.1% |

| 2015 | 9.2% | 8.0% |

Results before 2024-1-1 (the shaded area in the graph) are the realised performance of the same strategy as part of a larger portfolio managed by another investment manager.

Past performance is not indicative of future results.

How to invest?

To invest in the fund is easy:

1. Fill in the subscription form

2. Transfer the amount to the ING bank account of the fund

3. You buy against the monthly NAV

You can download the prospectus for the fund and other documents in the Clients area. Please contact us for your login details.

The MCK KEq Fund is a Dutch fund structure ("Fonds voor Gemene Rekening") and is administered by a professional third party. The accountant performs twice a year an audit and issues a (half)year report of the fund.

The fund is registered with the Dutch financial regulator, the AFM. Because of the investment threshold of €100k the fund is deemed to have only sophisticated investors and will therefore not be regulated by the AFM on a day-to-day basis.

Please contact us if you would like to know about the fund. We can explain the investment process in more detail.