AI Equity Fund

Systematic investing based on Machine Learning

Features

The AI Equity Fund is an innovative investment fund managed by Machine Capital. It offers unique features that make it an excellent addition to almost any portfolio.

Machine Learning

The selection of securities is based on return forecasts generated by an artificial neural network - one of the most powerful machine learning techniques.

State-of-the-art portfolio construction

A sophisticated portfolio construction algorithm generates the portfolio with the highest expected return while keeping the expected portfolio standard deviation below a predefined level.

Capital protection

When the portfolio risk can't be kept below its threshold with full exposure, the exposure is reduced and the remainder of the assets are kept in cash. This protects the fund against excessive risk in volatile markets.

Outperformance

The fund invests in European Equities. Its objective is to generate higher returns than its benchmark index (STOXX Europe 600) with lower risk.

Performance

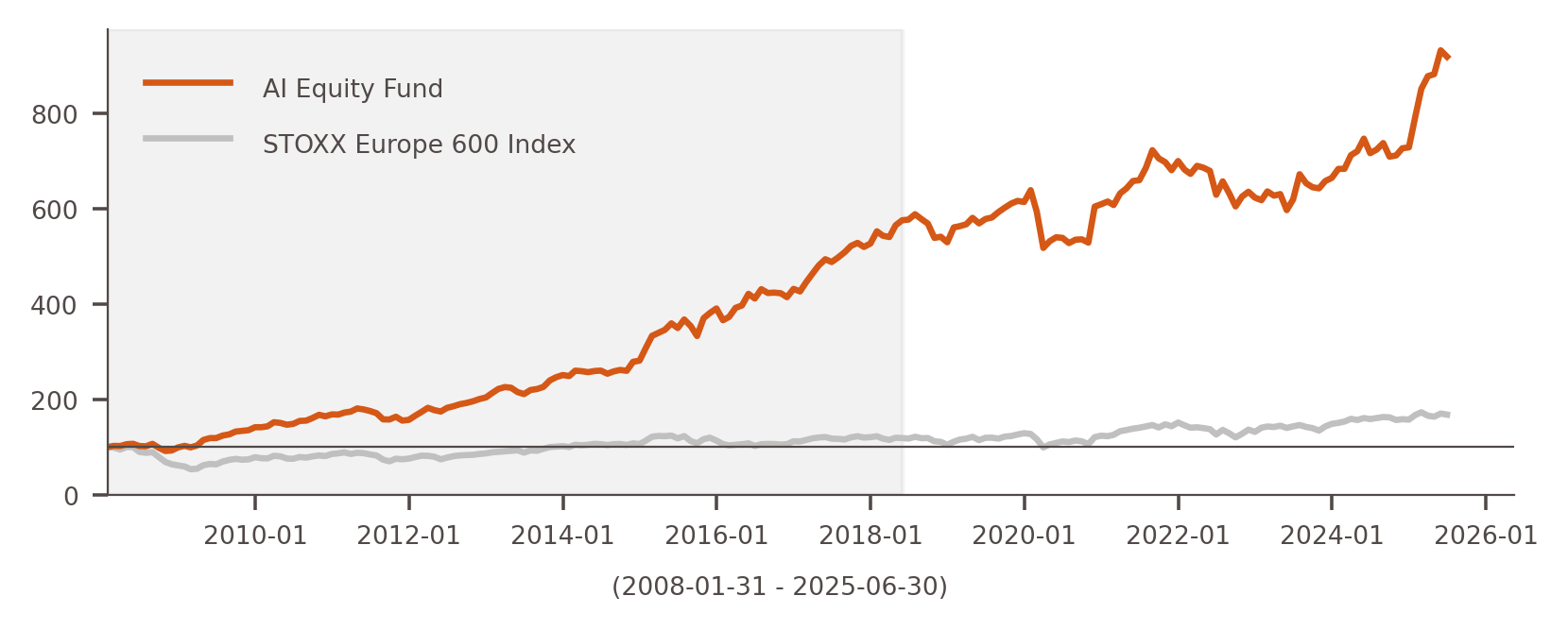

Simulated and realised performance compared to the STOXX Europe 600 Index

| AI Equity Fund | STOXX Europe 600 Index | ||

|---|---|---|---|

| Last 5 Years | Total Return | 70.5% | 50.2% |

| Annual Return | 11.3% | 8.5% | |

| Annual Risk | 12.7% | 13.8% | |

| Last 10 Years | Total Return | 162.7% | 42.0% |

| Annual Return | 10.1% | 3.6% | |

| Annual Risk | 12.7% | 14.0% | |

| Last 15 Years | Total Return | 517.5% | 122.5% |

| Annual Return | 12.9% | 5.5% | |

| Annual Risk | 12.2% | 13.3% | |

| Since Inception | Total Return | 817.9% | 68.0% |

| Annual Return | 13.6% | 3.0% | |

| Annual Risk | 12.4% | 14.7% |

| AI Equity Fund | STOXX Europe 600 Index | ||

|---|---|---|---|

| NAV | Return | Return | |

| 2025 (ytd) | 154.94 | 26.1% | 6.6% |

| 2024 | 122.88 | 9.6% | 6.0% |

| 2023 | 112.09 | 6.7% | 12.7% |

| 2022 | 105.10 | -11.0% | -12.9% |

| 2021 | 118.04 | 14.8% | 22.2% |

| 2020 | 102.78 | -0.8% | -4.0% |

| 2019 | 103.57 | 16.0% | 23.2% |

| 2018 | 0.5% | -13.2% | |

| 2017 | 22.0% | 7.7% | |

| 2016 | 10.5% | -1.2% | |

| 2015 | 38.8% | 6.8% | |

| 2014 | 12.1% | 4.4% | |

| 2013 | 23.0% | 17.4% | |

| 2012 | 29.9% | 14.4% | |

| 2011 | -6.8% | -11.3% | |

| 2010 | 19.0% | 8.6% | |

| 2009 | 42.3% | 28.0% | |

Results before 2018-6-1 (the shaded area in the graph) are based on simulations.

Past performance is not indicative of future results.

How to invest?

To invest in the fund is easy:

1. Fill in the subscription form

2. Transfer the amount to the ING bank account of the fund

3. You buy against the monthly NAV

You can download the prospectus for the fund and other documents in the Clients area. Please contact us for your login details.

The AI Equity Fund is a Dutch fund structure ("Fonds voor Gemene Rekening") and is administered by a professional third party. The accountant performs twice a year an audit and issues a (half)year report of the fund.

The fund is registered with the Dutch financial regulator, the AFM. Because of the investment threshold of €100k the fund is deemed to have only sophisticated investors and will therefore not be regulated by the AFM on a day-to-day basis.

Please contact us if you would like to know about the fund. We can explain the investment process in more details and together we can determine if the fund is a suitable investment for you.